GST Calculator - Easily Get Simple Tax Charge

Calculate GST Tax Accurate and Easy with Our GST Calculator

Get instant and error-free tax calculations with our user-friendly fast online GST calculator tool! Whether you're a business owner, accountant, or consumer, our calculator simplifies the process for all GST tax scenarios in India.

Most of products and services used in India are taxable to the unified indirect tax known as GST (products and Services Tax).It replaced multiple previously existing taxes with a single tax system. For both consumers and companies, it is essential to understand GST rates and calculations.

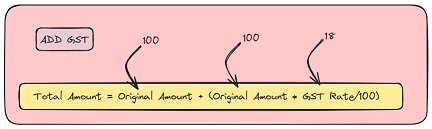

The steps and formulas for calculating GST are given below

- Identify the applicable GST rate: In India, different goods and services are taxable at different tax rates, which typically range from 5%, 12%, 18%, and 28%. You Make Chek The Official Website And Figure Out The Application Rate.

- Adding Gst Rate In Main Amount: Use the Formula = (Original price x GST rate%) / 100.

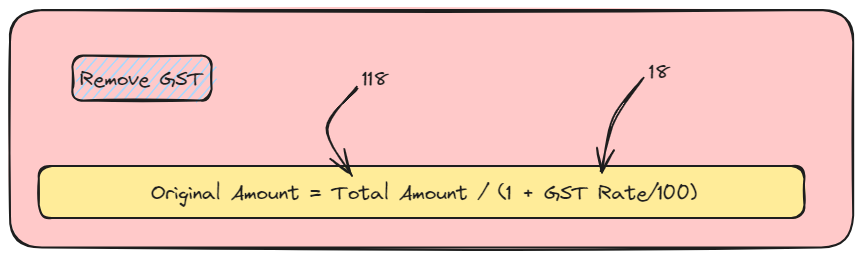

- Remove Gst Rate In Original Amount: Use the formula Original price = Total price / (1 + (GST rate% / 100)).

Example: A product costs ₹1,000 and has an 18% GST rate.

GST amount = (1000 x 18%) / 100 = ₹180

Find the total price: To get the final price, add the GST amount to the original price.

Total price = Original price + GST amount = 1000 + 180 = ₹1,180

Example: You paid ₹1,180 for a product, and you know the GST rate is 18%.

Original price = 1180 / (1 + (18 / 100)) = ₹1000

Our user-friendly GST calculator takes a Seconds of calculating Goods and Services Tax (GST). Whether you're a business owner, freelancer, or individual consumer, our tool helps you accurately Calculate the GST amount for any transaction in seconds.Calculate GST for different rates applicable in India (5%, 12%, 18%, 28%).Choose to calculate GST based on the price Add or Remove of GST.

Our Gst Tax Calculator Key Features:

- Supports all GST rates (5%, 12%, 18%, 28%)

- Handles CGST, SGST for different tax Calculation

- Calculates both inclusive and exclusive GST amounts

- Simple and fast interface for easy input and clear results

- No sign-up or registration required

- Accurate and reliable calculations based on official GST tax regulations